The sudden outbreak of COVID-19 in early 2020 has struck a heavy blow against the global economy, trade and investment. With effective control of the epidemic, China was able to quickly recover from the epidemic, with GDP growth rising from 2.3% in 2020 to 8.1% in 2021.

During 2017-2021, China's economy realized stable and favorable development. Increasing energy demand highlighted coal's role as basic energy source and important raw material. China's coal consumption totaled 20.2 billion tonnes in 2017-2021, but its share in energy mix dropped 4.6 percentage points to 56% in 2021. This was mainly owing to the "dual energy control policy" – the control of total energy consumption and consumption intensity.

To safeguard energy security, China has advanced supply-side structural reform, accelerated structural adjustment and distribution optimization, and improved the quality of development.

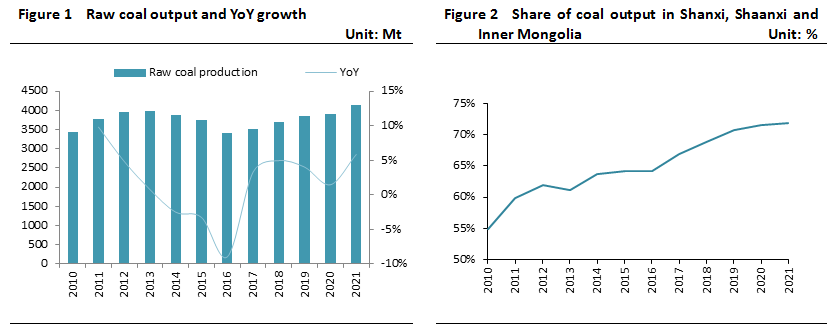

(1) The supply guarantee capability has been strengthened. From 2017 to 2021, China produced a total 19.1 billion tonnes of raw coal. Under the supply-side structural reform, backward coal mines were closed and production reduced in eastern and central regions, driving the center of coal production further to Shanxi, Shaanxi and Inner Mongolia.

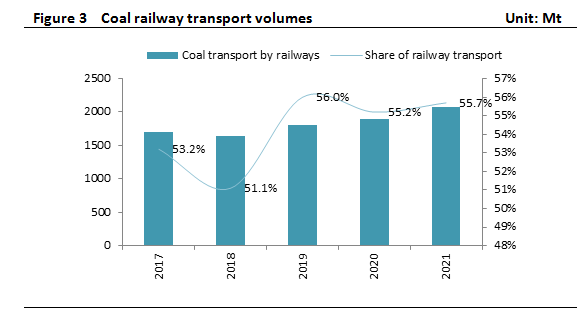

(2) The "road-to-rail transport" campaign has accelerated.

In August 2017, the State Council proposed to change coal logistics at Bohai Sea ports to railway or waterway transport and lift the proportion of railway transport. Coal logistics was increasingly depending on railway, with coal railing volume growing from 1.69 billion tonnes in 2017 to 2.07 billion tonnes in 2021, or a CAGR of 5.2% during 2017-2021.

Major railways such as Haoji and Zhunshuo were built up, and dedicated coal lines such as Shenwa, Jitong, Huzhun and Dazhun were renovated. By 2021, rail coal delivery accounted for 56% in China.

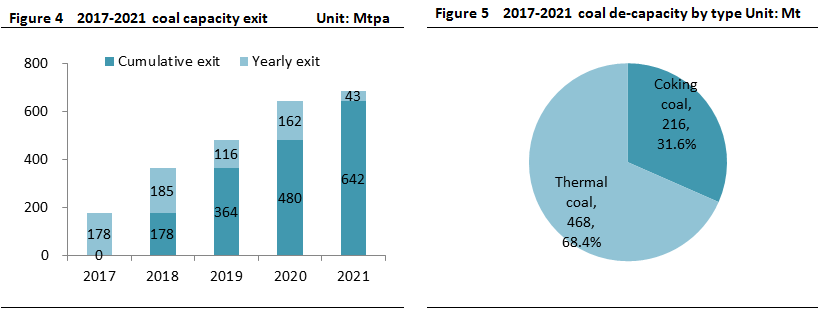

(3) The capacity structure optimization has achieved remarkable results.

In the beginning of 2016, the State Council issued a document on resolving surplus capacity in the coal industry. In the same year, the industry's 13th Five-Year Plan was released. The plan clearly stated that around 800 million tonnes of outdated capacity would be eliminated and around 500 million tonnes of advanced capacity would be added through capacity replacement and layout optimization. From 2017 to 2021, the policy focus evolved from overall capacity reduction to systematic de-capacity and capacity structural optimization.

During this period, a total of 1.02 billion tonnes of coal capacity were phased out, exceeding the planned target. In the meantime, high-quality capacity was released steadily, with newly-added capacity reaching 500 Mtpa, and capacity structure was constantly optimized. In 2021, the scale of large-sized coal mines with capacity ≥ 1.2 Mtpa accounted for 75.4% of the total, 5.5 percentage points higher than the end of 2016.

(4) Production safety and environmental protection improved steadily. The death rate per million tonnes of coal production dropped dramatically. The environment quality has improved noticeably at coal producing areas. The constraints on coal production from safety and environmental inspections has weakened.

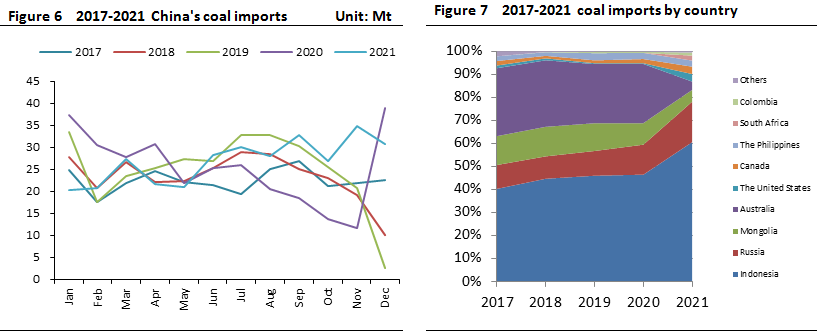

(5) Imported coal has effectively supplemented domestic market. From 2017 to 2021, China imported 1.5 billion tonnes of coal from overseas countries, greatly alleviating domestic supply pressure. China imports coal mainly from Indonesia, Russia, Mongolia and Australia, combined accounting for over 87%. Indonesia has been China's largest coal supplier, with the proportion rising from 40% in 2017 to 61% in 2021. Russia's share also went up from 10% in 2017 to 17.6% in 2021.

China forged ahead energy revolution from 2017 to 2021, and the energy structure was optimized, forming a multi-purpose supply system. Clean energy development is leading the world, and energy transformation has accelerated. However, unbalanced and inadequate development remains a serious problem. Overall, China's domestic coal supply tightened during some periods of time and coal price volatility intensified from 2017 to 2021.

Looking ahead to 2022-2026, the adjustment of global energy structure will speed up; the utilization of clean energy such as wind, solar and nuclear will increase, and the global efforts to fight climate change under the Paris Agreement have embarked on a new path. In September 2020, China announced the goal of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060. Coal will still be the main source in China's energy mix. What will be the trend of China's coal industry policy? Under carbon peak and carbon neutrality, how will China's coal industry structure develop? How will China's coal supply, transportation, imports and demand evolve? All these questions are worthy of in-depth research.

As an independent energy consulting company in China with long history and mature expertise, Fenwei has established professional research teams focusing on coal's upstream and downstream industries for many years, gaining a deep understanding of China's coal resources, coal quality and supply-demand fundamentals.

Fenwei is timely producing the long-term study reports on thermal coal, coking coal and met coke based on comprehensive data research, quantitative modeling and field surveys. We believe these long-term market reports will inspire you on coal/coke industry analysis & forecast.

The main viewpoints are as follows:

1) Coal's role and supply safety will be strengthened. Domestic coal supply is expected to stay high from 2022 to 2026, with cumulative output reaching 21.9 billion tonnes. Coal production continues to concentrate in Shanxi, Shaanxi and Inner Mongolia. The reverse distribution of coal supply and demand will become more prominent. As such, regional and periodical supply tightness will persist in China's coal market.

(2) The growth rate of energy demand is gradually slowing down. China's coal consumption is estimated to total 23.5 billion tonnes from 2022 to 2026.

(3) China will continue to boost railway and water-railway combined transports.

(4) The dependence on imported coal will fall in China. It is forecast China will import 1.4 billion tonnes of coal from 2022 to 2026.

(5) As domestic supply capacity further lifts and the supply-demand gap gradually narrows, coal market prosperity will decline.

Check this link for video introduction to these reports at https://youtu.be/Stc-qEbAkHo.

You are welcome to contact us at inquiry@fwenergy.com or +86 351 7219322 for more details about the reports.

(Writing by Tammy Yang Editing by Harry Huo)

For any questions, please contact us by inquiry@fwenergy.com or +86-351-7219322.

中文

中文