Australia's Queensland government has announced to raise its royalties on coal from July 1 following a 10-year freeze, with the top tier increasing to A$300/t for 40% royalties charge from the current A$150/t for 15% charge. The move would have greater impact on coking coal operations, though thermal coal will also be affected.

Queensland's coal production and exports

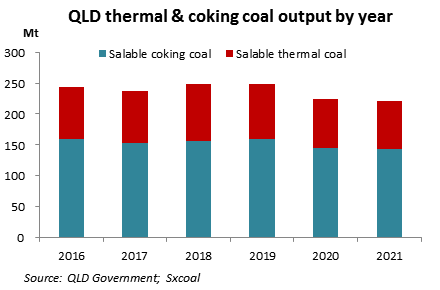

Queensland produces both coking coal and thermal coal, with the former accounting for roughly 66.87% of the total.

The state produced 220.65 million tonnes of salable coal in 2021, down 1.7% year on year, with salable coking coal output at 142.61 million tonnes and thermal coal at 78.04 million tonnes, showed data from the Queensland Government.

Queensland posted a 5.6% year-on-year decline in coal exports to 193.06 million tonnes during 2021, with coking coal accounting for 76.18% or 142.85 million tonnes.

Specifically, the state exported 101.78 million tonnes of hard coking coal and 41.07 million tonnes of soft coking coal, while thermal coal exports were registered at 50.22 million tonnes, data showed.

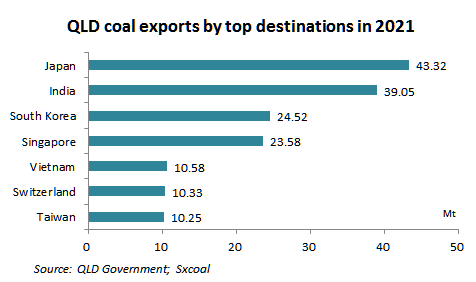

Queensland mainly exports coal to Asia. In 2021, the top destinations were Japan (22.4%), India (20.3%), South Korea (12.7%), Singapore (12.2%) and Vietnam (5.5%).

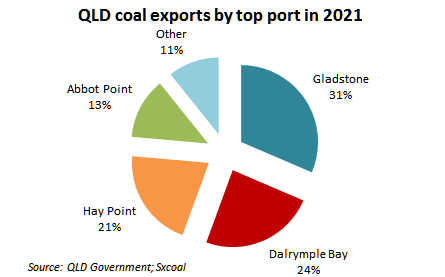

During the same period, top ports for coal exports were Gladstone (31.5%), Dalrymple Bay Coal Terminal (24.1%), Hay Point Coal Terminal (20.8%), and Abbot Point (12.9%).

Queensland's coal output share in Australia

Most of Australia's coking coal and thermal coal (both called black coal) is produced in Queensland and New South Wales, followed by Western Australia and Tasmania, with a vast majority exported to overseas markets.

Coal production in Queensland and New South Wales represents more than 98% of the country's total. Queensland mainly produces and exports coking coal while New South Wales mainly thermal coal.

Raw coal production in Queensland accounts for 55% of Australia's total in 2019, data showed.

In 2019, the estimate of Australia's recoverable economic demonstrated resources of black coal was revised upwards from 73.72 billion to 75.43 billion tonnes, up 2.3% from a year ago, with the large increment coming from Queensland's Hutton Coking Coal Project, the Olive Downs Coking Coal Project and Hail Creek in Bowen Basin and Wandoan in Surat Basin.

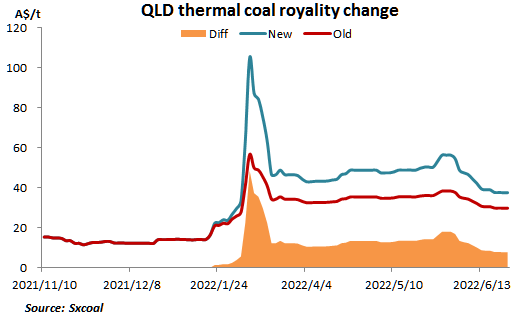

Coal royalties add higher costs to coking coal than thermal coal

The new coal royalties plan will add costs to coal produced in the state, with coking coal likely suffering the main part of the adverse inpact due to its much higher prices than thermal coal.

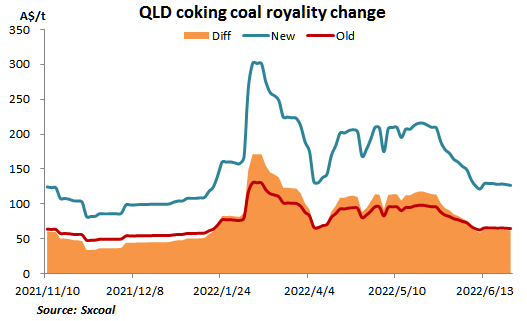

As requested by the Queensland government, starting from July 1, Queensland-based miners will have to pay 20% for prices above $175/t, 30% above $225/t and 40% above $300/t, according to the new coal tax policy.

Under the existing progressive scheme, coal companies pay a 7% royalty on the first A$100/t ($69/t) earned, 12.5% for earnings of A$100-150/t, and 15% for earnings exceeding A$150/t, which is the top tier royalties rate.

The new higher tiers only take effect on the portion of the royalty price above the relevant price, according to Cameron Dick, Queensland Treasurer and Minister for Trade and Investment.

"For example, if coal prices are A$302/t, a very high price by usual standards, the 40% tier will only apply to the $2 portion," Dick said.

Australian low-vol hard coking coal prices averaged at $353/t or A$511.4/t, FOB, so far in June. Miners would have to pay A$67.5/t of coal rate on average under the old scheme but A$134.1/t under the new rate, an increase of A$66.6/t.

However, thermal coal price averaged $190.3/t or A$275.8/t, FOB, so far this month. Miners need to pay A$32.1/t under the existing policy but A$42.4/t for the new, a rise of 10.22/t.

Despite the increase, during period of low prices, Queensland royalty rates will be lower than those charged in New South Wales, according to Dick.

New South Wales maintained its royalties unchanged at 8.2% for open-cut mined coal, 7.2% of underground coal and 6.2% of deep underground coal.

Around 91.8% of coal in Queensland comes from open-cut mines, according to Queensland Government data.

(Writing by Emma Yang Editing by Harry Huo)

For any questions, please contact us by inquiry@fwenergy.com or +86-351-7219322.

中文

中文