At present, China has imposed strict restrictions on coal imports. It's learned that coastal areas like Fujian, Guangxi and Guangzhou have curbed seaborne coal imports to varying degrees, but coal arrivals at Chinese ports showed these restrictions not yet to have a significant impact.

Sxcoal.com has learned that Fuzhou Maritime requires foreign ships to stay in quarantine for 14 days before berthing, in order to prevent new imported coronavirus cases from entering China. Only local end users are allowed to declare customs at Fangcheng and Qinzhou ports in Guangxi.

Earlier, market sources said that Guangdong's Xinsha Customs verbally notified local shipping agents and traders to restrict seaborne thermal coal arriving after March 16 as the local import volume has exceeded the quota of 6.5 million tonnes.

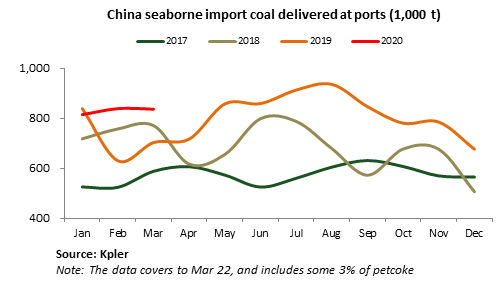

However, Kpler's ship-tracking data showed seaborne coal arrivals (incl. a small amount of petcoke) totaled 18.42 million tonnes from March 1 to 22, a decrease of 1.2% from the same period last month; the average daily arrival volume was 840,000 tonnes, a slight fall of 1,300 tonnes compared with the same period in February. In addition, there are approximately 8 million tonnes of cargoes in transit.

Indonesia, Australia and Russia remained the three largest suppliers. As of March 22, Indonesian coal accounted for more than half of the total arrivals, and Australian coal accounted for more than 30%.

China's seaborne imported coal arrivals reached nearly 24.32 million tonnes in February, down 3.7% month on month, according to Kpler.

It can be seen from the above data that although there's a decline in seaborne coal arrivals in March, it is rather small and nearly negligible in a time of flat demand from slowing resuming downstream sectors and seasonal weakness in demand.

In fact, China has tightened import control since the Spring Festival break in late January. Even so, there was still a sharp increase in coal imports. Chinese customs data showed coal imports in January-February reached 68.06 million tonnes, a year-on-year increase of 33%.

The surge in the first two months was mainly due to the sudden tightened restrictions at the end of 2019, which caused a large accumulation of imported coal waiting for customs clearance at ports. Entering 2020, curbs eased and a large amount of coal cargoes passed customs clearance in a short time.

In recent years, imported coal has gradually become an important regulator for the domestic coal market, stabilizing coal prices and ensuring the balance between coal supply and demand.

Chinese customs data shows that in the past five years, China's coal imports have fluctuated significantly in a V-shape. In 2013, China's coal imports amounted to 327 million tonnes, and then fell for two consecutive years, to 290 million tonnes in 2014 and 204 million tonnes in 2015.

In 2016, coal imports rebounded significantly to 255 million tonnes, an increase of 25.2% over the previous year; the total imports reached 271 million tonnes in 2017 with a year-on-year rise of 6.1%. Imports continued to climb to 280 million tonnes in 2018, a year-on-year increase of 3.9%, and further up to 300 million tonnes in 2019, up 6.3%.

The sharp increase in coal imports will squeeze the space for domestic coal demand, weaken the bonus left by the government's supply-side structural reform, and aggravate the contradiction between supply and demand in the domestic coal market. To this end, it's necessary to tighten coal imports appropriately.

Recently, import policies have gradually been tightened. Import quotas for large power groups have decreased by 20-30% compared with last year. Some power plants have reduced their quota by nearly half.

Some traders told sxcoal.com that the restrictions could be further tightened, as the rapid growing import is overdrawing the quotas in advance.

In addition, Kpler's data showed there were about 6 million tonnes of the delivered seaborne coal completed loading in March, or 1/3 of the total delivered coal over March 1-22, while most arrivals were loaded in February, accounting for 60%. This means that nearly half of the month-to-date arrivals were transacted in February, the worst period for virus epidemic in China.

During the period when domestic production was severely affected, coastal power plants replenished a large amount of imported coal, weakening the role of restriction policy in China's coal imports.

However, due to high coal inventory, coastal power plants are currently not active in purchasing overseas coal. Incidentally, there are not many Australian coal cargoes available for April loading, and offers are temporarily stable; Indonesian coal price has fallen near the break-even level. Coupled with the epidemic situation and the approaching of Ramadan, miners are keeping offer prices firmly.

In addition, factors such as fluctuations in global shipping freight rates and depreciation of Chinese yuan have increased the cost of imported coal, which has caused price gaps to narrow slightly between domestic and foreign cargoes.

According to calculation by Fenwei, Australian 5,500 Kcal/kg NAR thermal coal were only 88.4 yuan/t lower than Chinese domestic coal of the same grade as of March 23, based on CFR South China with 13% VAT, down 8.15 yuan/t than a week ago; Indonesian 3,800 Kcal/kg NAR coal price advantage was 23.73 yuan/t, down 10.93 yuan/t.

"Many importers dare not take positions recently, in part because low demand and bearish expectations about the near-term market," said a domestic importer. "Due to the recent sharp drop in oil prices, the cost of mining operation in Indonesia has decreased. If demand doesn't improve, there will be a bigger downward risk."

On March 23, Fenwei CCI index for Indonesian 3,800 Kcal/kg NAR coal was at $31.8/t FOB, compared with $34.5/t at the beginning of March, and CFR price stayed at $37.4/t South China, down $3.3/t from the start of March. The CCI index for Indonesian 4,700 Kcal/kg NAR coal fell $4.5/t to $50.5/t CFR.

Fenwei CCI index for Australian 5,500 Kcal/kg NAR grade was $59.8/t CFR, down $3.7/t over the same period.

In the short term, import restrictions would have limited impact on the market. However, as industrial enterprises in the south, like cement and steel mills, resume production, those heavily depending on imported coal as raw materials will be affected. They may have to increase purchases of domestic coal instead.

As the domestic epidemic situation is gradually contained in China, domestic coal supply has been largely restored to the same level as in previous years, while domestic demand continues to be sluggish. Therefore, demand for imported coal may decline to some extent.

(Writing by Alex Guo Editing by Harry Huo)

For any questions, please contact us by inquiry@fwenergy.com or +86-351-7219322.

中文

中文